A steady drumbeat of reporting reinforces a grim reality – 2022 was a financial disaster for U.S. health systems and the pain is far from over. Citing external economic factors like still-rising costs and changes in patient behavior, the Kauffman Hall National Hospital Flash Report for March 2023 states, “relatively flat margins are likely to continue in the near term.”

The pandemic badly skewed the traditional relationship between cost and revenue and righting it will take a thoughtful, far-ranging RCM strategy and the ongoing tactical execution to make it work. Here are just some of the ways health systems can look for hidden revenue to help boost the top line.

Fully leverage Medicare Bad Debt reimbursement

Unlike commercial payers, Medicare reimburses providers for 65% of bad debt, a total of $3 billion every year. However, providers can hit a reimbursement brick wall when they have the wrong MAC even after performing due diligence. Our government reimbursement team identified a pattern among clients of a certain MAC that refused to reopen Medicare Cost Reports, even though the request was legitimate and compliant with the three-year limit. On behalf of those clients we directly intervened with CMS to raise and resolve the issue and help our clients recover millions of dollars in additional revenue.

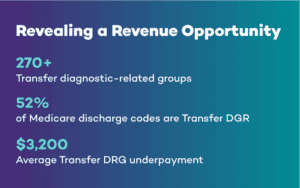

Target Transfer DRG underpayments

In 2020, an Office of Inspector General (OIG) audit of Post-Acute-Care Transfer Policy (PACT) compliance showed Medicare overpaid acute-care hospitals more than $267 million over a two-year period. Since then, MACs have scrutinized claims to determine if they qualify for a full MS-DRG reimbursement or for the alternate per diem payment resulting from transfer to a qualified post-acute care setting. As a result, many providers receive the smaller per diem amount for cases eligible for full transfer DRG charges or receive no reimbursement at all due to coding errors.

It is extremely advantageous for teams to know how to code and process transfer DRG claims so the MAC approves them on the first submission. Recovering underpayments can be quite difficult without the advanced technology and specialized expertise to find them for correction and resubmission.

Capture the value in complex claims

Before the pandemic, you couldn’t blame providers for some skepticism about the value of complex claims reimbursement. Often arcane and always complicated, workers’ compensation and Veterans Administration claims were sometimes dismissed as too resource intensive to convert so they remained hidden revenue. But these days optimizing this reimbursement can pay off in significant ways, with one health system doubling their VA and other military revenue.

Like VA claims, workers’ compensation is sometimes considered an RCM backwater, yet health systems can realize considerable revenue from these claims with the right strategy and execution. Especially today as hospitals face ongoing staffing shortages and specialized knowledge deficits, engaging a partner can help fill those gaps and expand another revenue opportunity.

Reconsider best options for patient payment engagement

The patient share of medical bills has been rising steadily as payers increase deductibles and out-of-pocket ceilings, and with it so has patient bad debt. Today more than 60 percent of new bad debt is coming from insured patients, and medical debt now impacts more than half of all American adults. Traditional patient payment models can only address part of the growing problem. Combining technology-driven digital payment options with compassionate call center services offers a more holistic, comprehensive approach that results in faster patient payments and improved patient experience.

Use data to identify and optimize hidden revenue opportunities

The promises of big data are delivering benefits for health systems willing to embrace analytics to strategically deploy RCM staff, accelerate reimbursement, and optimize revenue. How much you can get from your data depends on how you structure and manage it. Consider hospital and physician billing. It is not unusual for those data sets to be siloed, even within the same EHR. Linking that data for analysis can help uncover missed charges, coding mismatches, underpayments, and other revenue leakage.

Most providers have an abundance of data and lack the resources to turn it into insights that optimize revenue. This is where analytics can illuminate the landscape, help you discern the best path forward, and map out the strategies that will get you where you want to go.

Seek out and capitalize on unique pricing inefficiencies

When searching for every potential revenue opportunity, don’t overlook those that may be unique to geography. Blue Cross Blue Shield fee schedule variances in California, Idaho, New York, Pennsylvania, and Washington are good examples. Claims for eligible BlueCard patients receiving care in these markets can be submitted to either local Blue Cross Blue Shield plan, so knowing which plan will pay the higher fee can drive revenue for hospitals able to identify and leverage that variance. This BlueCard revenue stream has netted $2 million for a hospital with $2 billion in net patient revenue (NPR), and $12 million for a system with $6 billion NPR. That’s on an annual basis because this is all recurring revenue.

As health systems work to recover from the ongoing financial strain of the pandemic, labor shortages, inflationary pressures, and payer compliance complexity will continue to whip up strong financial headwinds. RCM leaders steering their systems toward a safe financial harbor will need to manage both sides of the ledger carefully. Bringing on guides that can help capitalize on the more meandering and less traveled revenue opportunities can be a powerful equalizer in the current economic climate.

To learn more about using advanced technology and deep healthcare RCM expertise to capture hidden and challenging revenue, email connect@r1rcm.com.