On August 19, 2022, the departments of Health and Human Services (HHS), Labor and the Treasury (the departments) issued a federal independent dispute resolution process status update.1 The departments reported that providers initiated over 46,000 disputes through the federal IDR portal alone between April 15th and August 11th, 2022. R1 RCM initiated over 5,000 of those disputes on behalf of its provider clients, accounting for more than 11% of the total disputes filed during this period. The departments noted that the disputes were substantially more than they initially estimated for a full year. How much more? In the 2021 interim final rule, the departments estimated that only 17,333 claims would be submitted as part of the federal IDR process each year. 2 In just four months, 165% more disputes were filed than the departments anticipated annually. In this regulatory brief, we will share some perspectives from our experiences under the new IDR framework.

Determination delays

During the first four-month period since the federal IDR portal went live, certified IDR entities rendered a payment determination in over 1,200 disputes, totaling a mere 2% of the filed disputes.3 Less than a year into the no surprises act and only four months into the federal IDR process, certified IDR entities have already blown through the statutory deadline for making payment determinations. Under the no surprises act, certified IDR entities must make a payment determination not later than 30 business days after the selection of the certified IDR entity.4 However, on September 7, 2022, CMS updated its IDR website5 to note it was allowing certified IDR entities additional time to make payment determinations.

The departments believe the primary cause of delays in processing disputes is the complexity of determining whether disputes are eligible for the federal IDR process, namely: (1) whether a dispute falls under state or federal jurisdiction; (2) correct batching and bundling; (3) compliance with applicable time periods; and (4) completion of open negotiations.

Jurisdictional complexity

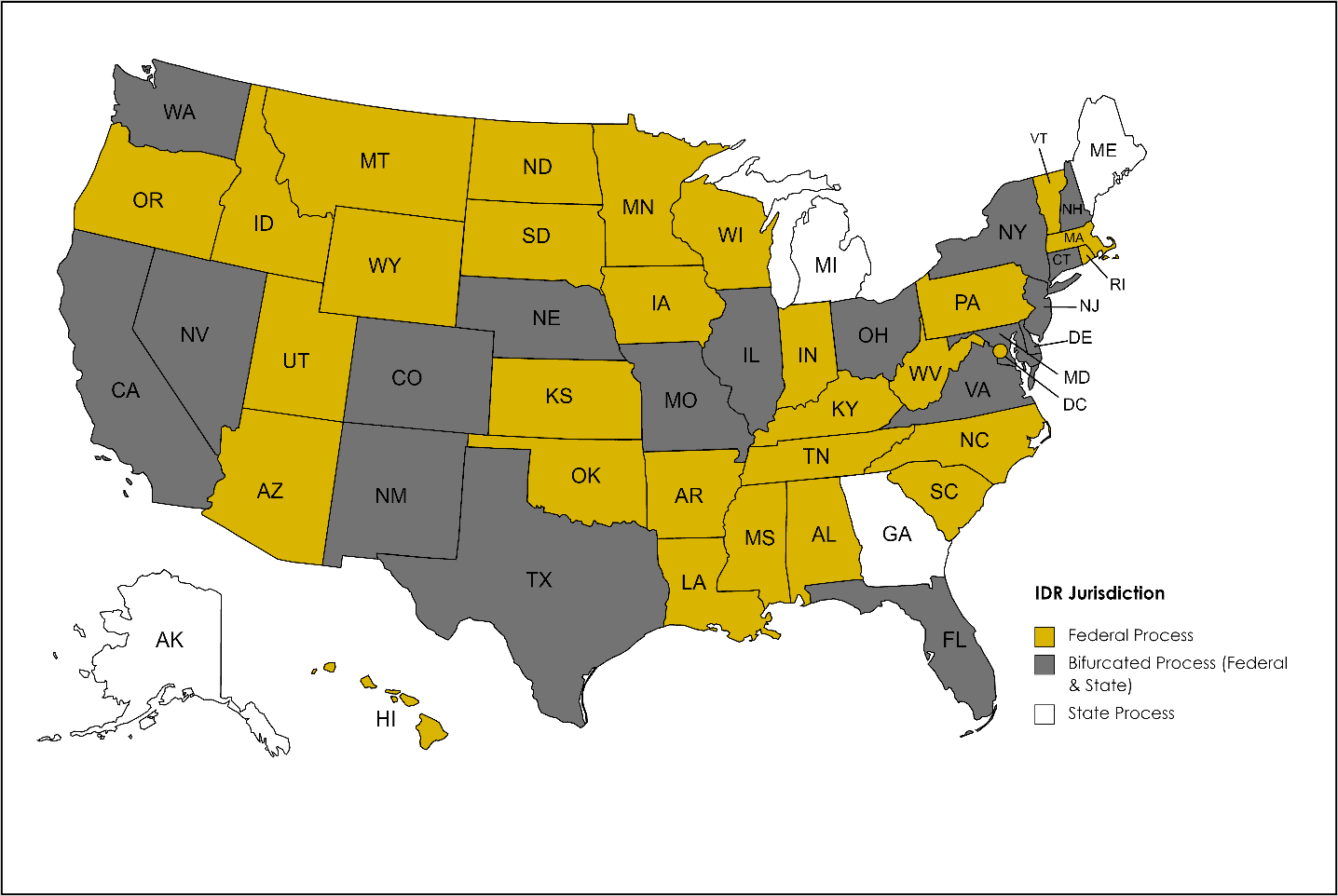

It is important to note that the departments’ data only reflects disputes initiated in the federal IDR portal. Four states maintain their own dispute resolution processes for provider-payer disputes, while 18 states divide jurisdiction between the federal and state processes.

The department’s response

Concurrent to the IDR process update, the departments published their final rule6 requiring additional payer disclosures. These additional disclosures are intended to equip providers with more information about the claim adjudication and qualified payment amount (QPA) calculation. Taken together, the departments believe this would reduce the complexity causing the delays in payment determination. As stated, the departments are of the view that increased understanding and compliance with the disclosure requirements will foster the exchange of necessary information within the federal IDR process, resulting in faster completion of the eligibility review.7

R1 regulatory team’s perspective

Despite the provider-friendly steps taken by the departments, we believe the policy changes ultimately fall short. Specifically, we are not persuaded these changes will materially reduce the following: (1) volume of disputed claims filed; (2) time to deliver a payment determination; and (3) backlog of pending disputes. In the table below, we break down our perspective on the regulatory requirements versus the regulatory realities.

| Requirement | Policy Goal | Reality |

|---|---|---|

| QPA Remittance Advice | Payers are required to disclose certain claim adjudication information, such as whether the QPA was downcoded, so providers have necessary information to determine whether to dispute a claim. | The departments declined to require that payers use remittance advice remark codes to indicate whether claims were even adjudicated pursuant to the no surprises act.8 Additionally, it is unclear how some of the QPA data elements required with initial payment can or will be included in an 835 standard transaction. |

| Initial QPA | The initial payment must be an amount payer reasonably intends to constitute payment in full based on the relevant facts and circumstances. | There is no minimum initial payment amount requirement for payers, nor any penalties for abusive claims payment practices. |

| Jurisdiction | The No Surprises Act’s statutory authority is limited in jurisdictions where an existing state dispute resolution process exists. | Disputing parties and certified IDR entities must interpret a complex decision matrix of federal preemption and state law for each claim where minute details, such as the presence of certain common procedural terminology (CPT) codes, can drive whether state or federal dispute resolution applies.(9) |

| Timely Disclosures for Additional Information | Documentation included with the initial payment or notice of denial of payment must detail information about the QPA. Upon request, certain additional information must be provided in a timely manner by the payer. | Payer failure to provide required information that allows a certified IDR entity to evaluate whether a claim is eligible for federal IDR and batched appropriately pauses the IDR process until additional documentation is received.(10) Payers have little incentive to expedite this process by disclosing the required information timely. Further, no current guidance allows a certified IDR entity to penalize a payer for failing to meet its obligations. Instead, the certified IDR entity is merely directed to inform the affected party of its ability to file a complaint through the No Surprises Help Desk.(11) However, given the volume of disputes and noncompliance, we believe it is unrealistic that the appropriate agencies will be able to enforce, penalize or deter non-compliant behavior at this time. |

| Notice | Disputing providers are required to notify the payer of the intent to engage in open negotiation to encourage parties to settle disputes prior to IDR. | Payers often dispute receipt of the required notice. Copies of e-mails and letters are frequently required to be provided for each claim to demonstrate required notice has been provided.(12) This process delays eligibility determinations by certified IDR entities and, ultimately, any payment determination. |

| 30 Business Day Open Negotiation | Entities are encouraged to use this time to come to a mutually acceptable agreement prior to IDR. | Payers fail or refuse to negotiate prior to IDR forcing providers to file claims with the certified IDR entity. |

| Disputed Claim Batching | Grouping same or similar items or services allows for efficient resolution of disputed claims. | For self-insured group health plans, qualified IDR items or services can be batched only if payment is made by the same plan, even if the same third-party administrator (TPA) administers multiple self-insured plans.(13) Often it is unknown whether claims from the same TPA are from the same or different plans, making it impossible for disputing parties to know whether it is appropriate to batch. |

While we appreciate the steps the Departments have taken to improve the IDR process for providers, we believe these changes will fail to realize their policy goals without stronger incentives for payer compliance and specific penalties for noncompliance. The Departments are accepting feedback on the IDR process and encourage stakeholders to communicate any concerns and suggestions on improvements to the No Surprises Help Desk going forward.

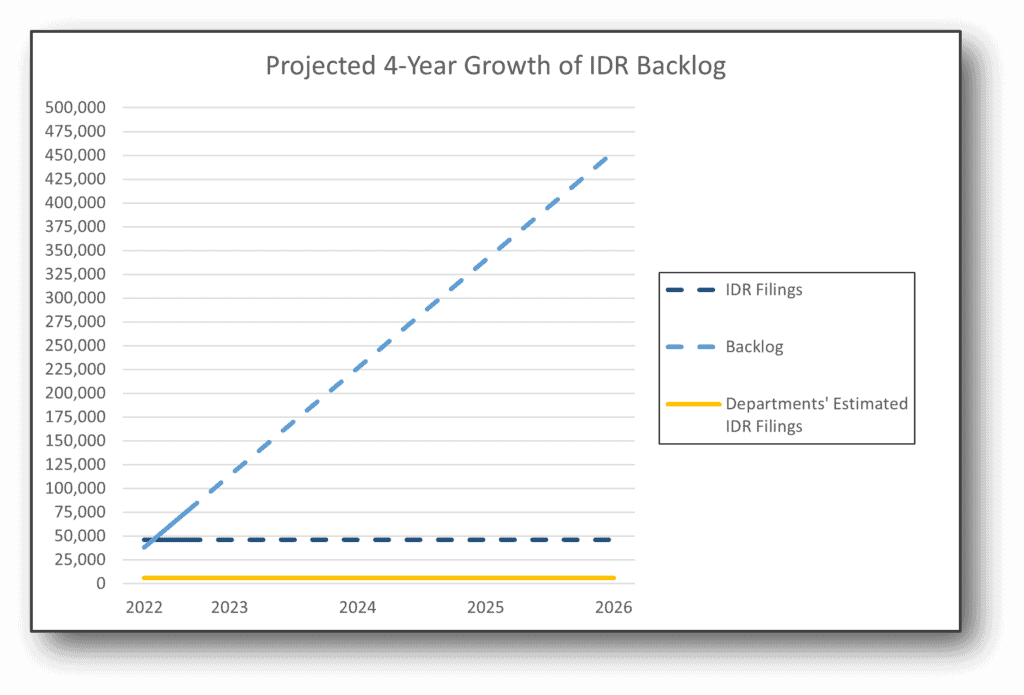

Based on the departments’ update on the first four months of the federal IDR process,14 the R1 regulatory team calculated the potential backlog growth if the dispute numbers in the first four months continue forward. This calculation assumes no changes in number of available certified IDR entities, the number of IDR filings, the time it takes to certify eligibility, and the number of payment determinations made.

With R1’s technology-enabled suite of revenue cycle management tools, as well as a team of dedicated regulatory affairs and regulatory compliance attorneys, we can provide guidance in navigating IDRs and the entirety of the No Surprises Act. If your hospital or health system is looking for a strategic partner in promoting best practices, please contact us.

Looking for more information on the no Surprises Act?

R1 has a wealth of No Surprises Act reading materials. Check them out.

1 Centers for Medicare & Medicaid Servs., Payment disputes between providers and health plans, available at https://www.cms.gov/nosurprises/help-resolve-payment-disputes/payment-disputes-between-providers-and-health-plans (last visited Sept. 19, 2022).

2 Requirements Related to Surprise Billing, 87 Fed. Reg. 52618 (Aug. 26, 2022) to be codified at 45 C.F.R. Part 149, available at https://www.govinfo.gov/content/pkg/FR-2022-08-26/pdf/2022-18202.pdf.

3 Federal Dispute Resolution Process Status Update, supra, 1.

4 FAQs About Affordable Care Act and Consolidated Appropriations Act, 2021 Implementation

Part 55 (“FAQs”), Q19, p. 22 (Aug. 19, 2022), available at

https://www.dol.gov/sites/dolgov/files/EBSA/about-ebsa/our-activities/resource-center/faqs/aca-part-55.pdf.

5 Centers for Medicare & Medicaid Servs., Chart Regarding Applicability of the Federal Independent Dispute Resolution Process in Bifurcated States, available at https://www.cms.gov/files/document/applicability-federal-idr-bifurcated-states.pdf.

6 FAQs, supra, 8 at Q20, p. 23.

7 Id., p. 24.

8 Id., p. 23.

9 Technical Assistance for Certified IDR Entities (August 2022), p. 2 (Aug. 19, 2022), available at https://www.cms.gov/files/document/TA-certified-independent-dispute-resolution-entities-August-2022.pdf.

10 Federal Independent Dispute Resolution Process Status Update, supra, 1.

11 Id., p. 24.

12 Id., p. 23.

13 Technical Assistance for Certified IDR Entities (August 2022), p. 2 (Aug. 19, 2022), available at https://www.cms.gov/files/document/TA-certified-independent-dispute-resolution-entities-August-2022.pdf.

14 Federal Independent Dispute Resolution Process Status Update, supra, 1.

Disclaimer: This blog is for educational purposes only, and is current as of September 21, 2022. Not intended to be used as, or constitute legal or medical advice. Our statements are on behalf of R1 only and, in turn, are not intended to reflect or otherwise represent the viewpoints or positions held by R1 customers. This newsletter contains predictions on future trends in healthcare, including on regulations not yet published. Readers are cautioned not to place undue reliance on such predictions.

Author Bio: Regulatory Affairs & Regulatory Compliance Team