- What We Do

- Back

- Enterprise Solutions

- Revenue Recovery

- Revenue Optimization

- Clinical Integrity

- Regulatory Navigation

- Who We Help

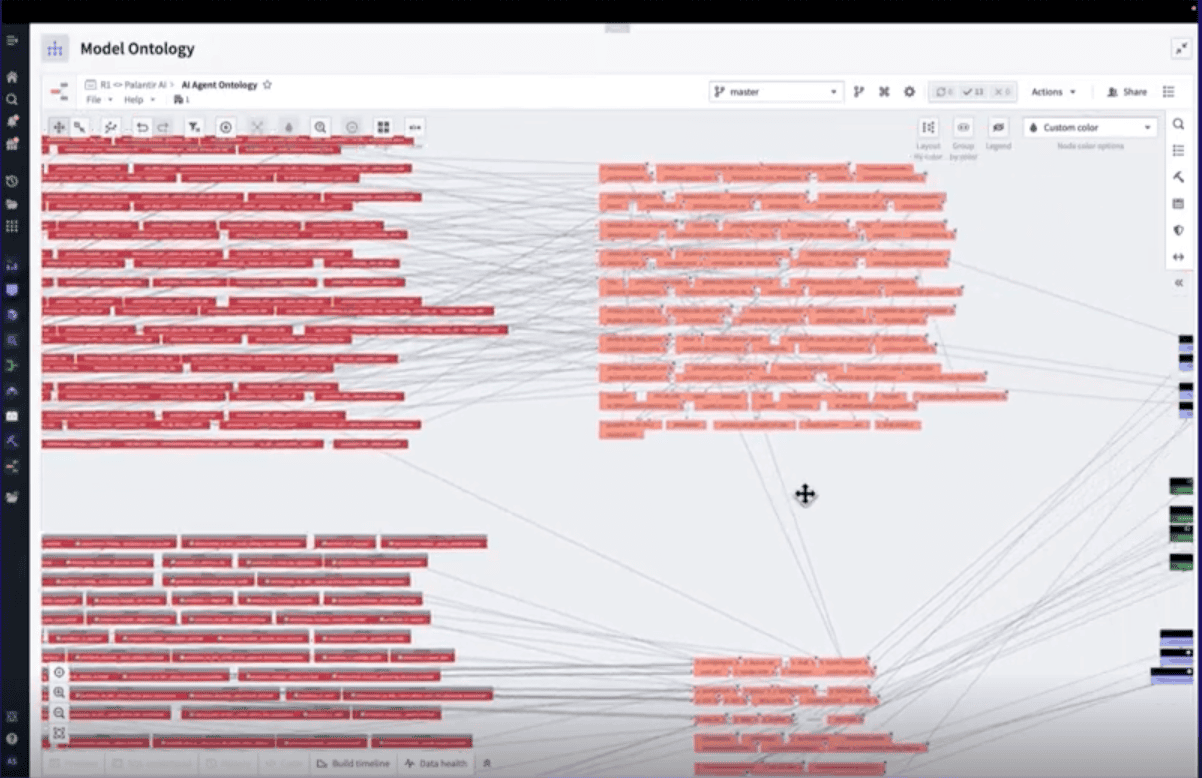

- Our Platform

- Insights and Resources

- About Us

- Careers

- Insights and Resources

- Articles

Articles

Subscribe to get the latest R1 resources in your inbox

Subscribe to our email list to get the latest in your inbox